Josh Talbot contributed to this article.

While most tend to think of Bitcoin as a novelty item for a technologically inclined sub-culture, the nuts and bolts that make Bitcoin possible, Blockchain, has tremendous potential to impact all of us. Its story starts with trust.

Trust is a foundational element in culture. Yet maintaining trust in today’s world, with an increasingly digital global economy is expensive, time-consuming, and inefficient. While financial institutions are leading the way, many organizations are exploring how Blockchain might provide a viable alternative to the current procedural, organizational, and technological infrastructure required to create institutionalized trust. Though these exploratory efforts are still emerging, the payoff could be profound.

Similar to how the Internet reinvented communication, Blockchain may also disrupt transactions, contracts, and trust—the underpinnings of business, government, and society.

But what is it? Distilled to its core, Blockchain is a trust mechanism, a distributed ledger that provides a way for information to be recorded and shared by a community. Here’s an example. Imagine a whiteboard in a dormitory hallway that keeps track of who paid for last Friday’s pizza, providing both ease of editing and public availability. This wouldn’t stop someone from editing the list to their personal advantage. Maybe the dorm RA could oversee the list, but the RA could make a mistake, or leave over the weekend, or even edit the list to his or her own benefit. The dorm needs a public ledger constrained by rules of consensus to keep residents from modifying the list to their exclusive benefit. While an oversimplification, this narrative illustrates what Blockchain seeks to accomplish: combining universal accessibility with best possible security in flexible degrees of anonymity.

That’s still a mouthful. Let’s go back a few hundred years to medieval Halesowen, England for another simplified example. While peasants plowed fields and Arthur conquered kingdoms, authorities kept track of everything from real estate arrangements to birth records to merchant transactions in the court roll. Halesowen residents used this “shared ledger” as a public record that served as a trusted entity for private information, like the whiteboard in the dormitory. However, this arrangement required a trustworthy steward, or third party.

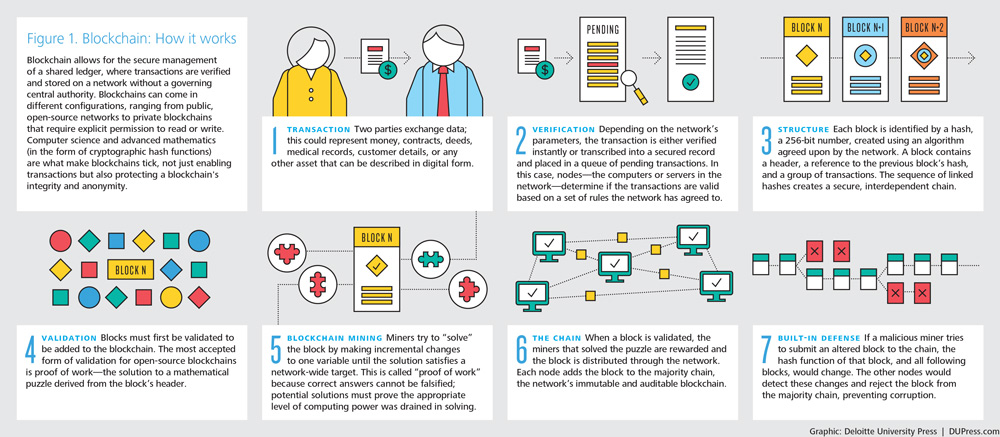

In Halesowen, insider threat and malicious outsiders could tear pages out, add fictitious information, edit transactions, or even alter someone’s identity. A medieval version of Blockchain would allow for the secure management of a shared ledger, where transactions are verified and stored on a network without a governing central authority.

In 13th century England, it might look something like this. Instead of a single book housed in a single location, the “shared ledger’s” pages (nodes or blocks) would be distributed across the town. Each page would have a symbol on it that indicates its lineage in the ledger, but the only way to identify the proper path (chain) that links the pages together is through a map (key). The private information would be publicly available but only meaningful with the key. This arrangement would provide security, accessibility, and a degree of anonymity, but would throw the town into chaos because adding a new record would require running around town following the “chain” of “blocks”. Fortunately, the computing power of the 21st century eliminates this challenge.

Today Blockchains can come in different configurations, ranging from public, open-source networks to private Blockchains that require explicit permission to read or write. Computer science and advanced mathematics (in the form of cryptographic hash functions) are what make Blockchains tick, not only enabling transactions but also protecting a Blockchain's integrity and anonymity.

Gartner estimates that 80% of financial institutions will have started a Blockchain project by the end of this year, but other industry areas have also put thought into Blockchain as a disruptor. The government of Honduras is exploring how to use Blockchain smart contracts for real estate registry. Philips Healthcare and HealthNautica have both partnered with Blockchain startups to prototype health record systems, and IBM’s Watson is exploring the marriage of artificial intelligence and Blockchain for applications with the Internet of Things.

As our lives become more entrenched in online and digital services, the problem of maintaining trust and transparency with regard to digital identities and information is growing more urgent. Blockchain will not solve the problem, but it could be part of the answer.

via D27n205l7rookf

Resources

"Top Strategic Predictions for 2016 and Beyond: The Future Is a Digital Thing," Gartner

"Gem Partners With Philips for Blockchain Healthcare Initiative," CoinDesk

"Healthcare: Can the Blockchain Optimize and Secure It?" Bitcoin Magazine

"IBM Watson is Working to Bring AI to the Blockchain," CoinDesk

Image

"Blockchain: Democratized Trust," Deloitte University Press